Grow your enterprise business with a multichannel customer experience

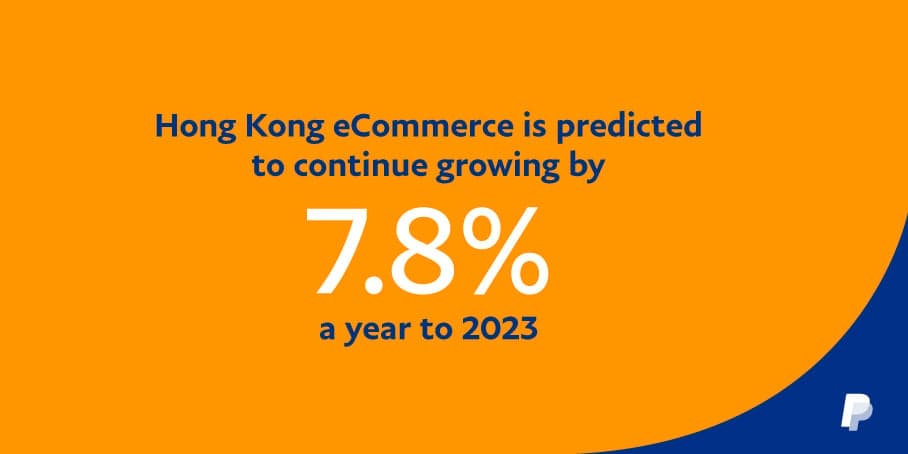

As online shopping continues to grow, enterprise businesses can claim back lost revenue and stay ahead of competitors with an increased focus on multichannel experiences.

Recapturing growth

To increase competitiveness and take advantage of the eCommerce growth, enterprises should focus on improving their end-to-end online shopping experience. As shopping behaviour moves to multiple platforms, like mobile, social commerce and marketplaces, enterprises can increase demand by meeting customers where they shop. To do that, they will need a multichannel commerce plan.

So what is multichannel?

One of those buzzwords of the past few years, multichannel effectively means selling across multiple sites, services and devices. New technologies enable businesses to get in front of their current and prospective customers, wherever they are when they’re ready to buy.

However, as businesses look to sell beyond their own website, the loss of control of data across providers and solutions can create increased friction in the backend and further impact efficiencies.

Finding alternative ways to sell

In addition to being available on multiple platforms such as their own websites and social media platforms like Facebook, Instagram and Pinterest, new technologies offering new commerce opportunities are popping up frequently.

One that’s gradually gaining traction is live-stream eCommerce. Customers can view and buy from live online video streams, often hosted by celebrities or influencers.

Other innovative solutions include Landmark shopping mall’s eChat shopping service, which allows customers to text with store staff and place orders through WhatsApp.

And, of course, when in-store, customers need a seamless payment solution that lets them pay the way they want to. With PayPal QR codes, customers can securely check out on their mobile and transactions are recorded alongside online payments via one PayPal account.

Improving customer experiences across platforms

Hong Kong consumers are looking for three things when buying online: value for money, product quality and ease of shopping experience. According to a recent KPMG study, positive shopping experiences bring customers back for more, increasing their lifetime value (LTV).

With an optimised checkout process, businesses can also increase conversion rates and improve loyalty and repeat purchases. Here’s how:

- Collect as little information as possible through keyboard-optimised fields to let customers finalise their purchase quickly.

- Offer customers’ preferred payment methods, whether that’s credit card, PayPal, UnionPay or JCB.

- Securely store card information so customers don’t need to key in their details every time.

Creating frictionless payment experiences, wherever customers buy

As businesses work to improve their enterprise payments, there are 5 steps towards frictionless payments: optimising checkouts and increasing conversions, improving customer lifetime value (LTV), ensuring security at every step, improving back-end systems, and scaling across markets.

Implementing a multichannel commerce solution with a single integration, like the PayPal Complete Payments, can help businesses move towards frictionless payments. With one payments solution, each step can be managed and optimised centrally, improving efficiency and cost-effectiveness.